2018 Profit And Loss Form

- Download Free Profit Loss Form

- Irs 2018 Profit And Loss Form

- Fillable Profit And Loss Statement

- Irs Profit Loss Form 2018

(Form 1040) Department of the Treasury Internal Revenue Service (99) Profit or Loss From Business (Sole Proprietorship) Go to www.irs.gov/ScheduleC for instructions and the latest information. Attach to Form 1040, 1040NR, or 1041; partnerships generally must file Form 1065. Name of proprietor.

A Profit and Loss Statement Form or Income Statement is a component of Business Financial Statement Forms that outlines the total revenue and total expenses of a company over a given period of time, usually a fiscal year. From its name itself, it helps a company identify if there were any profit or loss during the given period. This way, the company can assess their profitability or their ability to generate income.

Related:

- Profit and loss templates give you the information you need when you need it for peace of mind and transparency. Just plug in revenue and costs to your statement of profit and loss template to calculate your company’s profit by month or by year and the percentage change from a prior period.

- Forms and Publications (PDF) Instructions: Tips: More Information: Enter a term in the Find Box. Select a category (column heading) in the drop down. Form 11-C: Occupational Tax and Registration Return for Wagering 1217 « Previous.

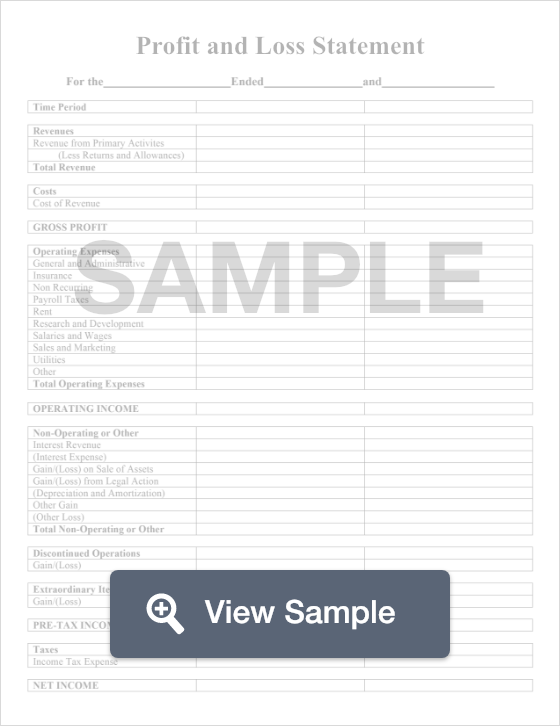

Sample Profit and Loss Statement Form

Example Monthly Profit & Loss Statement Form

Profit and Loss Statement for Homeowners

Free Profit and Loss For Human Services

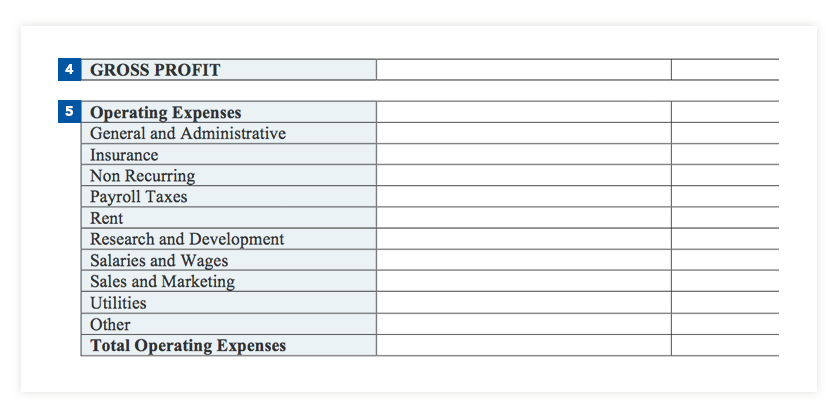

Parts of a Profit and Loss Statement Form

- Gross Profit: This is calculated by subtracting the cost of goods sold from the net sales. The net sales includes the revenue from products and / or services sold after the deduction of returns, allowances, discounts, and damaged or missing items. The cost of goods sold comprises the cost of direct labor and materials, any overhead expenses that went into manufacturing the products.

- Operating Income: This is calculated by subtracting the operating expenses from the calculated gross profit. Operating expenses are those that go toward administration costs, like the wages of employees that do not directly have anything to do with manufacturing the product. Other expenses included in this bracket are utilities, marketing, insurance, transportation, and depreciation of assets among others. The resulting value, which is the operating income, is the total income of a company from its normal business functions.

- Non-operating Income: This is the deduction of non-operating expenses from non-operating revenues. These are expenses and revenues that do not have anything to do with the normal functions of the business. Common examples are interest from the sale of investments, and losses from lawsuits and interest paid to lenders.

- Net Income: This is the leftover income after all expenses have been deducted. If it is positive, then there is a profit. If it is negative, then there is loss. The net income is then added to the retained earnings of a company, which can be used to invest in business activities. You may also our other Statement Forms like our Witness Statement Form and Statement of Information Form.

Business Profit and Loss Statement Form in Excel

Fundraiser Profit and Loss Statement Form

Self Employment Profit and Loss Statement Form

Schedule C Profit and Loss Statement Form Format

Calculating the net income of your company over a given period of time can allow you to see if you’ve made any profit. This information, along with a cash flow statement, can help you identify areas of improvement for budget cuts to increase your income and decrease expenses. This can be done quarterly and annually for close monitoring, because as a company grows, the revenues grow as well, but the expenses could also be growing at a faster rate. You may also see our Sample Financial Statement Forms for other parts of a Business Financial Statement. This can help you have a more integrated outline of your company’s financial standing.

Related Posts

Let’s face it; business financial accounting is a fundamental process, which helps to determine the health status of your business as well as the likelihood of its potential growth. In accounting, different documents are used. One of the most important categories of files that the accounts team cannot and won’t do without is the profit and loss forms. These are files used to determine whether a business incurred profits or otherwise in a given period. If you are looking for the Financial Forms for business use, here is a list that you might find helpful.

Related:

Sample Profit & Loss Statement Form

A profit and loss statement form shows you whether you’ve made profits over a given period. Otherwise, you should record the data down for analysis and business forecasting. You may also see Business Financial Statement Forms.

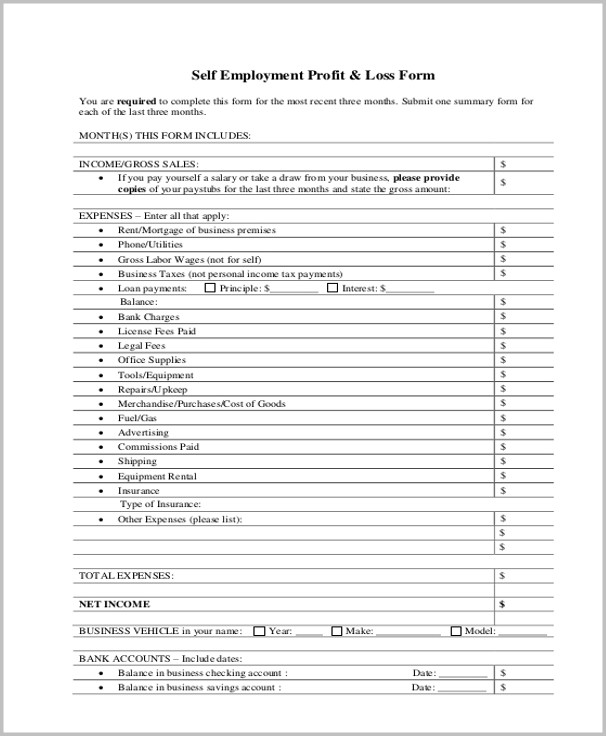

Self Employment Profit & Loss Form

If you are self-employed, this sample file is for you. It makes it possible for you to track how much profit or loss you make from your business after every set period. Download the file for free today.

Downloadable Profit or Loss Business Form

Doing business can be risky, it always is. At the end of the day, you are not sure whether you will make profits or losses. However, you need a profit or loss from business form to do the analysis before arriving at the conclusion.

Blank Profit and Loss Form in PDF

Download Free Profit Loss Form

The one thing that makes this template special is that you can download it for free. Also, you don’t have to spend a lot of time customizing it because it is already available for immediate print. You can also see Financial Statement Forms.

Quarterly Profit & Loss Statement Form

This template is best for businesses that often conduct their financial accounting process at the end of every three months. The results can be used to make changes to your business and bring about improvements over time.

Personal Profit and Loss Statement Form Format

If you are in your own business, it would be great if you use a personal profit and loss account for financial accounting after every period that you’ve set for the task. You can download the file by following the link below.

Profit and Loss Statement for Small Business Form

Irs 2018 Profit And Loss Form

This sample form is suitable for small businesses that don’t have a lot of financial accounting needs on a month to month basis. Use this for small business accounting.

Free Monthly Profit & Loss Statement Form

If you would rather conduct a monthly financial accounting, this will be the best sample file to use. It is suitable for personal businesses as well as small businesses that are growing rapidly. You may also see Sample Income Statement Forms

Example of Profit and Loss statement Form for Self-Employed

The profit and loss account for self-employed persons is a free sample form available for free download. You use this template if you do not have time to create your own design from scratch.

Simple Profit and Loss Statement

What are The Uses of Profit and Loss Forms?

- Conduct the analysis, compile the results, and then write a financial report for the period specified. Use the report you just wrote to determine whether your business made profits or incurred losses over the given period.

- You can use the profit and loss data to do business forecasting. Business forecasting is the art where you determine the future of your business based on the current financial statistics. Of course, although the forecast is not always accurate, it can help give you the idea about your business in the terms of a future placement.

What are The Benefits of Profit and Loss Forms?

Fillable Profit And Loss Statement

- Every file in this thread is free to download. In fact, you don’t need a template builder. Also, you don’t need to hire someone to create these files for you. At the end of the day, you save time and money.

- These templates can be used as is. It means you do not really have to customize them after download. Instead, you should start doing your accounting immediately. Because these files are designed to make your work easier, it is important that you take advantage of them every time you want to conduct a financial analysis for your business.

With many sample profit and loss files for different audiences already available on this page, there is no real reason why you should even think of creating these files from scratch. The term different audiences in this context mean individuals, companies, and small businesses that must use these files for accounting. You can also see Financial Evaluation Forms.